- FCA TO CONSULT ON REDRESS SCHEME ‘UP TO £18bn’

- INDEMNITY WARNING FOLLOWING SUPREME COURT DCA RULING

- ECG CONFUSION STALLING EV ORDERS

- COMPETITION PROBE INTO BCA-ASTON BARCLAY DEAL MOVES TO NEXT STAGE

- LABOUR TO PENALISE LATE PAYMENTS TO SUPPLIERS

- WEEK AHEAD: Bank of England interest rate decision

- ASTON MARTIN’S US REGISTRATION RUSH TO BEAT TARIFFS

- IoD: CONFIDENCE IN UK ECONOMY FALLS TO RECORD LOW

- LITHIA ‘NOT GETTING ENOUGH CREDIT’

- CDK DOWNGRADED BY S&P

- OPINION: A better way of redress

FCA to consult on redress scheme ‘up to £18bn’

The Financial Conduct Authority has today stated it will consult on an industry-wide scheme to compensate motor finance customers who were treated unfairly. The consultation will be published by early October, be open for six weeks, and will be finalised in time for people to start receiving compensation in 2026.

The FCA says it is proposing a redress scheme because “many firms were not complying with the law or our disclosure rules that were in force… where consumers have lost out, they should be appropriately compensated in an order, consistent and efficient way”.

Factors that will be considered include the size of commission relatively to the charge for credit, the nature of commission, the characteristics of the consumer, compliance with regulatory rules and the extent and manner of disclosure.

The FCA says the scheme should cover agreements dating back to 2007, but it has not yet decided whether to propose an opt-in or opt-out scheme.

The total cost of redress will probably range between £9bn-£18bn, with a mid-point of this range most likely. “Most individuals will probably receive less than £950 in compensation.”

Johnson v MotoNovo

Although the Supreme Court threw out two of the three cases the Appeal Court allowed, it ruled in the third case, that of Johnson v FirstRand Bank (which trades as MotoNovo in the UK), the finance agreement was unfair under the Consumer Credit Act 1974.

It is responding to the details of this case that appears to be guiding the FCA’s consultation.

“The statutory test of unfairness under the Consumer Credit Act allows courts to take account of a very broad range of factors and is highly fact-sensitive,” said Lord Reed, who delivered the Supreme Court’s ruling.

“There are three relevant factors on the facts of Mr Johnson’s case. First, the size of the commission paid by the finance company to the dealer.

“It amounted to 55% of the total charge for credit. The fact that the undisclosed commission was so high is a powerful indication that the relationship between Mr Johnson and the finance company was unfair.

Secondly, it is highly material that the documents provided to Mr Johnson did not disclose the existence of a commercial tie between the finance company and the dealer, under which the finance company was given a right of first refusal of customers referred by the dealer.

“Thirdly, on the other side of the scales, is Mr. Johnson’s failure to read any of the documents provided by the dealer. However, Mr Johnson was commercially unsophisticated and the court questions the extent to which a finance company could reasonably expect a customer to have read and understood the detail of such documents, particularly when no prominence was given to the relevant statements.

“For these reasons, the court holds that the relationship between Mr Johnson and the finance company was unfair and that the finance company should pay the amount of the commission to Mr. Johnson with interest at a commercial rate from the date of the agreement.”

He awarded Mr Johnson the commission payment plus interest. This figure amounts to £1,650.95 plus interest.

* Read the FCA statement in full

Indemnity warning following Supreme Court DCA ruling

Retailers aren’t quite home and dry following Friday’s Supreme Court ruling on DCA finance claims, according to lawyer Jonathan Butler.

Butler, who works for law firm Geldards and is retained by the Vehicle Remarketing Association, warned there was a chance lenders could look at their indemnities in finance supply agreements that enable them to reclaim payouts from dealer groups.

Speaking to Auto Sunday, Butler said: “Any lender and dealer worth their respective salt will have put in an agreement, an indemnity. My concern has always been, and I’ve not seen a case yet that’s come to the fore, but I have been asked a couple of times by dealer groups what their potential risk is, but if a lender is on the hook for money in any of these remaining claims, it may well be going back to their dealer agreements and saying, is there an indemnity provision here that we can enforce against the dealer?”

Butler likened the possibility to opening “Pandora’s Box” because of the ramifications this would have on the relationship between the lender and retailer.

However, Butler’s broader view of the Supreme Court ruling was that common sense had prevailed and that far fewer people would qualify for claims than originally estimated.

ECG confusion stalling EV orders

Retailers are reporting mixed fortunes following the launch of the government’s Electric Car Grant with several retail groups reporting customers delaying buying, and either cancelling orders or threatening to cancel orders to make sure they receive the grant.

Market experts also expect more consumers to follow suit once the confusion over which vehicles will qualify is resolved.

Auto Trader’s head of insights Marc Palmer believes retailers will have to handle customers of sub-£37,000 EVs carefully as any buyer who’s already ordered a car that qualifies for the grant but is expecting delivery in the next few months will be expecting the discount to be applied.

Palmer said he expected a “pause” in EV orders “but the market should catch up either in September or by the end of the year”.

However, the consumer behaviour depends on the brand in question, according to retailers Auto Sunday spoke to this week. Those with premium brand franchises selling EVs priced well above the £37,000 grant cap have reported no change to customer behaviour.

Other retailers, particularly those operating new entrant brands which have launched their own EV ‘grant’ offers, have seen increased consumer interest and orders.

Leapmotor, the first brand to offer a ‘grant’ style offer, is understood to have been so overwhelmed by orders for a particular finance offer that its plan to run the offer for a quarter has been cut back.

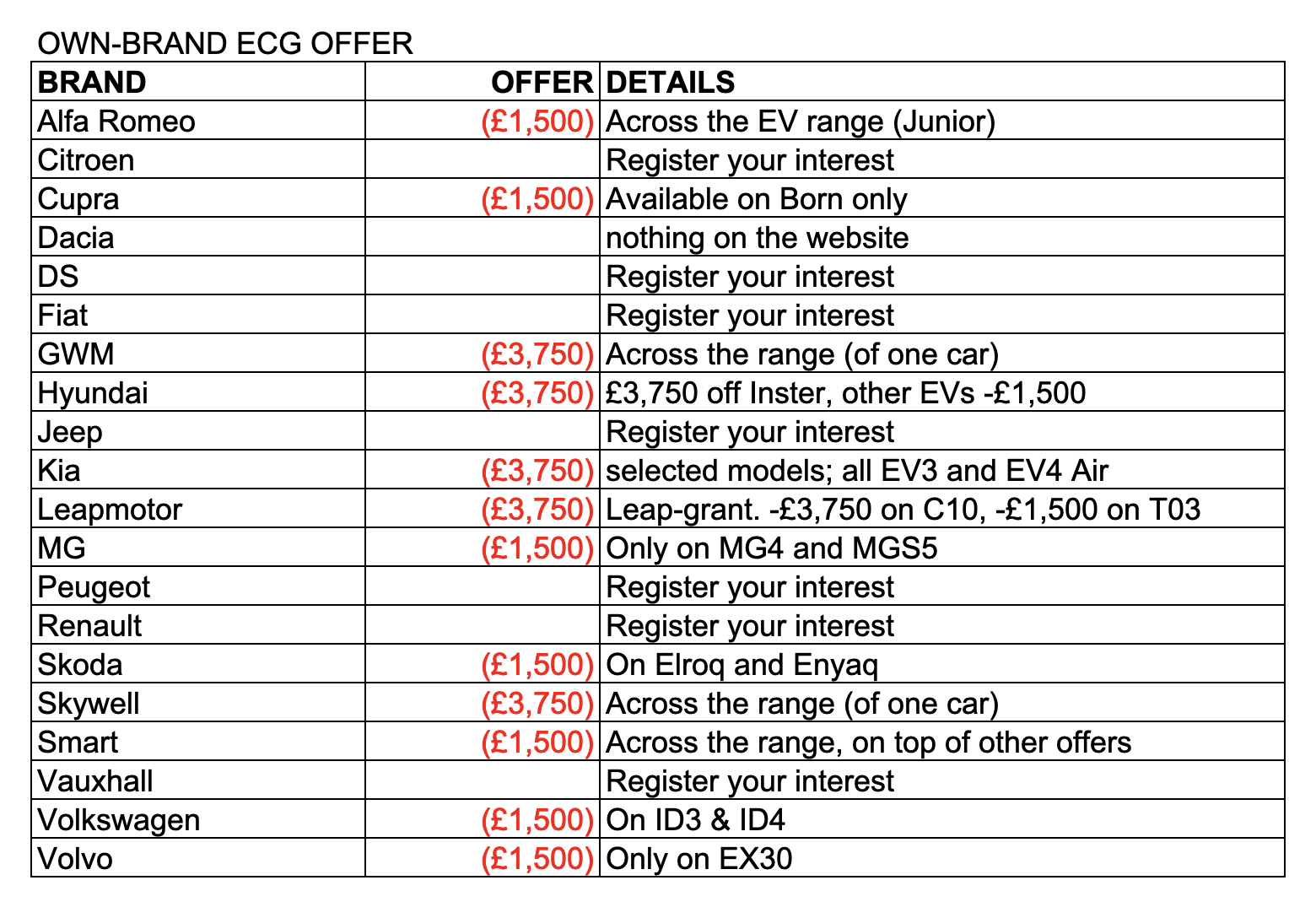

Auto Sunday has drawn up a table showing which car makers have introduced own-brand ECGs including discount details.

Greater clarity over which cars qualify for the grant is expected after 11 August – the date when the Government will start approving vehicles.

Competition probe into BCA-Aston Barclay deal moves to next stage

The Competition and Markets Authority has moved to the next stage in its investigation of Constellation’s takeover of Aston Barclay last year. Constellation owns Britain’s largest vehicle remarketing business BCA, as well as Marshall Motor Group and Cinch.

The competition watchdog now has “sufficient information” to begin its formal first phase inquiry into the transaction. The probe, first reported by Auto Sunday in May, will assess whether the deal raises competition concerns and whether a more detailed Phase 2 investigation is warranted.

The clock on the CMA’s statutory review started on 1 August, giving the authority until 29 September 2025 to decide whether to escalate the case.

Industry observers will be watching closely to see whether the CMA sees grounds to proceed to a Phase 2 investigation, which could delay integration plans or result in remedies to address any antitrust concerns.

Labour to penalise late payments to suppliers

Labour is preparing to impose fines and penalties on businesses who repeatedly delay payments to their suppliers. The cost of late payments has escalated to £11bn a year, reports The Guardian, with as many as 38 businesses a day shutting down partly owning to late payments. Planned changes will include handing the small business commissioner powers to impose fines, potentially worth millions of pounds.

Business secretary Jonathan Reynolds has also announced startup loans for 69,000 companies worth £4bn “to inspire the next generation of entrepreneurs and small business owners”.

WEEK AHEAD

Tuesday, UK retail sales

Thursday, Caffyns AGM

Thursday, Bank of England interest rate decision

DATA INSIGHT

Aston Martin’s US registration rush to beat tariffs

328: The number of cars Aston Martin delivered within 24 hours in the US as it rushed to qualify for lower tariffs that came into effect on 30 June. It represents three months’ worth of cars invoiced to retailers in a single day.

IoD: confidence in UK economy falls to record low

-72: Worst ready of the Institute of Directors’ optimism index, the worst reading since the research started nine years ago. The July reading was down from -53 in June.

GLOBAL AUTO

Lithia ‘not getting enough credit’

Lithia Motors “isn’t getting enough credit for its business as a whole,” CEO Bryan DeBoer said during the company’s Q2 earnings call. “It’s shocking the microscopic views that the market is taking on what we’re doing when we’ve grown our organisation threefold in revenue and threefold in earnings.”

Automotive News reports DeBoer saying Lithia is set up for accelerated growth in H2 2025 after net income rose 19% year-on-year to $258m. Revenue rose 3.8% to $9.6bn, a quarterly record.

CDK downgraded by S&P

DMS giant CDK has been downgraded from B+ to B- by Standard & Poor’s because of “softer than expected” Q1 trading results and “higher customer churn” in the wake of two cyberattacks last year. CDK “faces more challenges as it defends its leading market position… business recovery is taking longer as industry peers are likely encroaching on its market position and slowly taking share”.

OPINION

A better way of redress

Until earlier today, this opinion piece was going to try to offer some clever new insight into Friday’s Supreme Court ruling. Possibly, this could have been commenting on how retailers aren’t quite out of the woods yet on finance claims. Or possibly how any FCA redress scheme may work.

However, this morning, I read a LinkedIn post by Matt Wigginton who works for automotive charity Ben.

His clarity of thought about the bigger picture when it comes to the whole topic of redress payments following Lord Reed’s judgement is both a beautiful and simple idea.

This is Matt’s idea: “The Supreme Court ruling on car finance compensation is good news for the industry, no doubt, but I suspect it’s been an incredibly stressful and uncertain time for anyone involved in car finance or retailing since the cases were first initiated.

“To my reckoning, members have set aside around £2bn for potential compensation and that will likely now be released.

“How impactful would it be if they, collectively, donated just 1%, or even 0.1% of that figure to support the well-being of automotive industry colleagues whose wellbeing needs urgent support?

“I can tell you. it would enable Ben to make an immediate and life-changing difference to the lives of around 10,000 more people in our industry this year.

“Our industry relies on its people. Our people rely on them. Everyone can rely on Ben.”

With estimates of the amount now needed for claims dropped from £40bn to possibly less than £10bn, that reduction is currently only going to benefit shareholders. Gifting a small percentage of any savings to charity seems to me to be a painless way of helping the primary powerhouse of our industry, and that’s the people.

So, come on lenders, who’s going to step up first?

Tristan Young

Editorial Director

Get in touch: tristan@autosunday.co.uk

ISSN 2977-6597

Comments 1